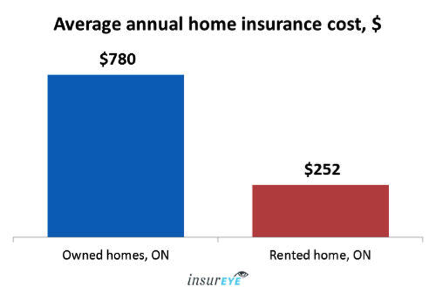

Home Insurance in Ontario Averages $780

There are multiple factors that determine your average home insurance cost in Ontario—from location and your home’s rebuild costs to home construction materials and proximity of sprinklers. Also, such aspects as old house elements or recent renovations are considered when determining your home insurance rates. But what are these rates?

On average, homeowners in Ontario pay approximately $780 and renters pay $252. In other words, homeowners pay three times as much as tenants to protect their homes.

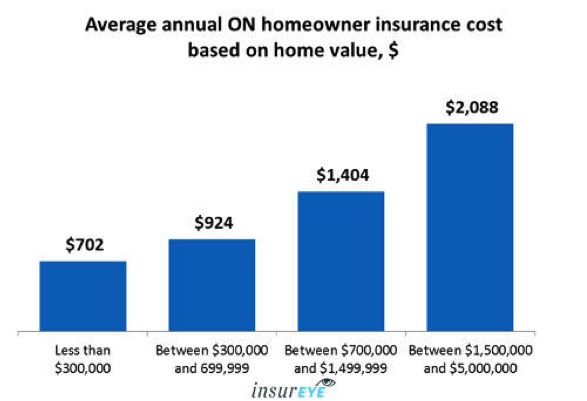

Although the market value of your home does not directly impact what you pay for insurance, it can give you an idea of what you can expect to see in terms of costs. Normally it is a rebuild value of your house that needs to be considered when buying a home insurance policy.

Nevertheless, statistics say a home valued at under $300,000 generally sees an average home insurance cost in Ontario of $702 a year, and homes in the higher brackets—between $300,000 and $700,000, for example—can expect to pay approximately $924. But again, the final numbers will be impacted by other factors.

Obviously the more expensive the home is, the more insurance you’ll pay, but this isn’t a reflection of market value; it’s often a straight numbers game. A more expensive home means a more expensive home to rebuild, or a home with more expensive attributes to protect. If your home falls in the $700,000 to $1.5-million range, it’s reasonable to see the average home insurance cost in Ontario hit the $1400 mark annually, and over $2,000 for homes in the $1.5-to-$5-million range.

Obviously the more expensive the home is, the more insurance you’ll pay, but this isn’t a reflection of market value; it’s often a straight numbers game. A more expensive home means a more expensive home to rebuild, or a home with more expensive attributes to protect. If your home falls in the $700,000 to $1.5-million range, it’s reasonable to see the average home insurance cost in Ontario hit the $1400 mark annually, and over $2,000 for homes in the $1.5-to-$5-million range.

What factors determine home insurance costs?

Different factors have different impacts on your home insurance costs, so we’ve listed the most important ones below.

Numerous factors have a strong impact on home insurance rates: province/location, neighbourhood (due to many influencers, like crime rates), electrical wiring, type of your piping and plumbing, house age and any completed renovations, any types of high risk stoves (like wood stoves) and oil-based heaters.

Several factors impact insurance rates but not as significantly as the previous list: the type of your house frame (like wood or concrete), distance from water sources (like sprinklers), any additional endorsements that you need (for jewellery, for example), size of insurance deductibles, and business conducted from home.

The last category lists the factors that sometimes can somewhat impact your home insurance rate: installed alarm monitoring, your family status, availability of a garden, and some other smaller items. That should equip you with an initial insurance checklist that you can use next time when shopping for a new home insurance policy.

Find the Plan to Cover Your Property

For over 30 years Acumen Insurance has been a leader in providing personal home and auto insurance products. We have always excelled in providing our clients with the best options to suit their needs and lifestyle. Let us help you choose the right home and auto insurance policy for you. Call and speak to one of our brokers directly 905-574-7000 or get a quote online now.

These insights offered by InsurEye, a Canadian company that provides independent, innovative online services such as consumer insurance reviews.